Norwich Credit Union Mobile App

New app gives 'fingertip' access to the credit union

Norwich Credit Union has developed a new mobile phone app to support the increasing numbers of people using its online services.

Individuals can now interact directly with the credit union from their smartphone. As long as they have access to WiFi or 4G, they can use the app to manage their credit union account, get information about opening times etc, apply for membership or offer their services as a volunteer.

Jon Warne, president of Norwich Credit Union, says:

"The new mobile phone app makes us visible at all times. It raises our profile and helps us stay closer to our members, who are always just a ‘fingertip’ away."

"Our credit union is run by volunteers with limited resources. We’re finding that more and more people are engaging with us online. The new app increases the ways that members can communicate with us, and hopefully will help us reach more potential new members in Norfolk."

The new Norwich Credit Union app was developed on behalf of the credit union by Community IT Services CIC (CITS), a new community interest company committed to bridging the digital divide in Norfolk. Karen Downer, Community Liaison Manager for CITS, explains:

"We started developing the app for the credit union in August 2018. There were several challenges to overcome, mainly relating to integration with the online banking system."

Testing of the apps was particularly interesting, as we opened this up to the Norwich Credit Union members. With their feedback we were able to identify the features that were most requested for the apps."

The new Norwich Credit Union app is available now on Google Android smartphones and iPhones from their respective app stores.

Opening Times for our Phone Lines

As a volunteer-run financial co-operative, it is not possible for us to man phones at all times during the day, therefore our line opening times are as outlined below. At all other times please email or leave a message on 01603 764904. We will try to respond to any emails or messages we receive before 2pm on the same day.

Line opening times:

Monday to Wednesday: 10:30-12:30 & 1:30-2:30

Friday and Saturday: 10:30-12:30 & 1:30-2:30

Thank you for your patience and understanding.

Terms and Conditions

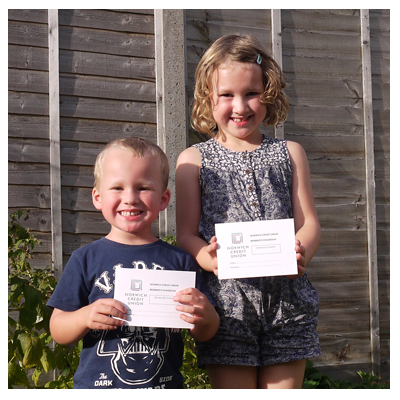

Thanks to Stop Loan Sharks (England Illegal Money Lending Team), we’re announcing an exciting offer for NEW MEMBERS!

To qualify, you must

If you meet all 3 conditions, we’ll add £25 to your account at the end of the 3 months!

Simply put £25-SLS in the "Promotion Code" section of our Join Online form. Terms and conditions apply – see below.

Only 50 people can qualify for this offer. So hurry - sign up today, or tell friends and family if you’re already a member!

Contact the office if you have any questions.

What is Stop Loan Sharks?

Stop Loan Sharks (England Illegal Money Lending Team) investigate and prosecute illegal lenders or loan sharks. A loan shark is someone who lends money as a business without the legal authorisation required by the Financial Services and Markets Act. They rarely give any paperwork and if repayments are missed they often use violence and intimidation to get their money back.

When loan sharks are convicted, Stop Loan Sharks look to seize their assets under the Proceeds of Crime Act. A small proportion of the money generated from these assets can be used to fund education and crime prevention initiatives, such as this Norwich Credit Union membership incentive scheme.

£25 voucher - terms and conditions